Trade smart. Deep liquidity. Maximize profitability.

Join one of the largest and most liquid trading networks — with access to live interest from over 700 market participants and the tools to execute transactions in real time across 60+ countries.

How it works

Fragmented Liquidity

Scattered markets and bilateral relationships limit trading opportunities and price discovery.

Counterparty Risk

Difficult to validate creditworthiness and trading history across multiple counterparties.

Manual Workflows

Time-consuming processes for RFQs, negotiations, and contract execution slow down trading velocity.

Pricing Opacity

Limited visibility into real-time market pricing and live trading interest across regions.

Compliance Burden

Complex documentation requirements and registry procedures create operational overhead.

Portfolio Tracking

No centralized system to monitor positions, track trade history, and analyze portfolio performance.

Access the Largest Trading Network

Connect to live trading interest from over 700 market participants including utilities, aggregators, and professional traders. Real-time visibility into bids and offers across 60+ countries — ensuring you can execute at competitive prices with minimal slippage.

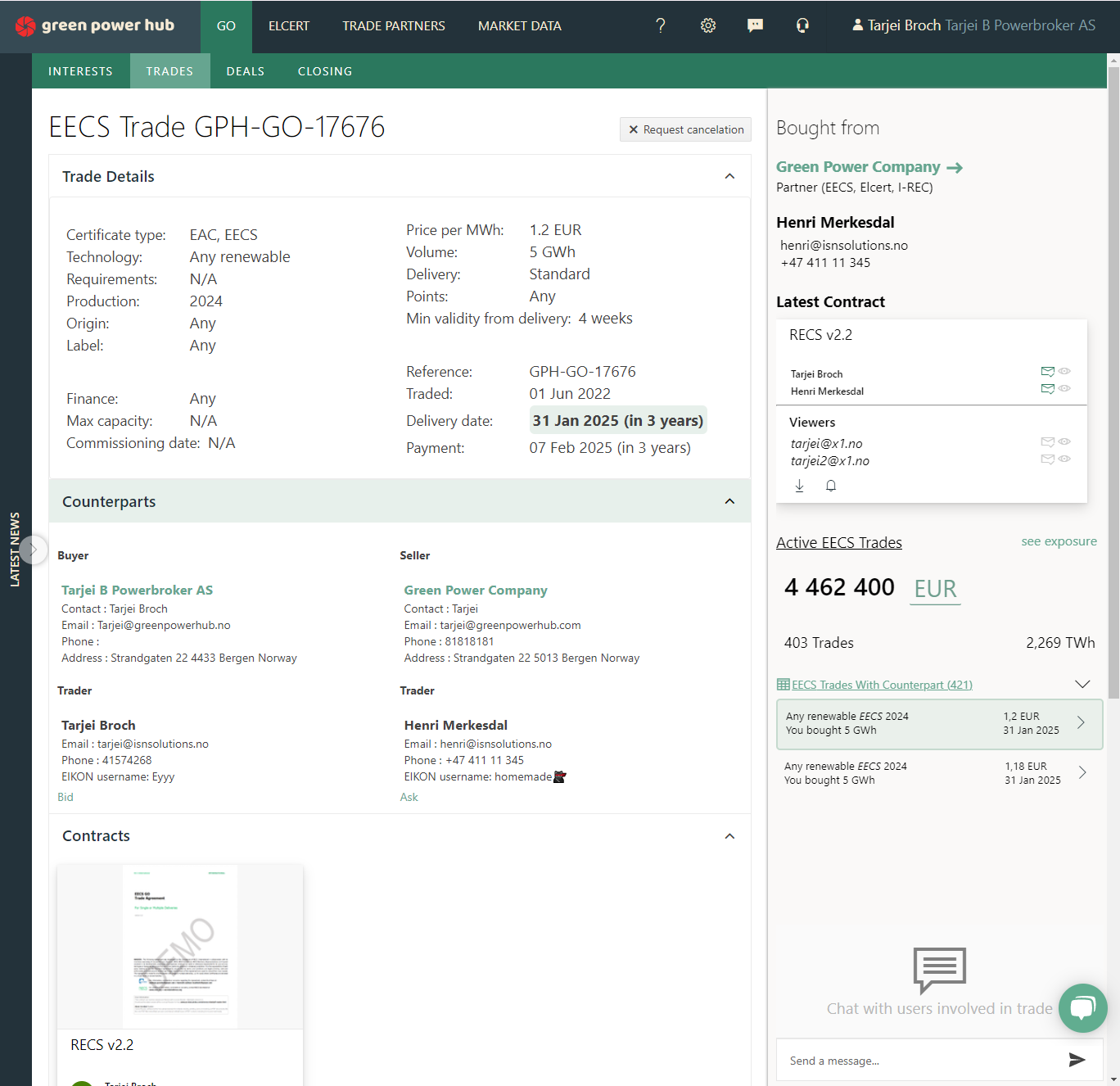

Execute Trades in Real Time

Post firm, actionable trading intentions and respond to counterparty interest instantly. Our color-coded counterparty system (Green/Red/Blue) lets you manage your preferred trading relationships while maintaining anonymity until deal confirmation. Chat negotiation enables price discovery while protecting your identity until you're ready to disclose.

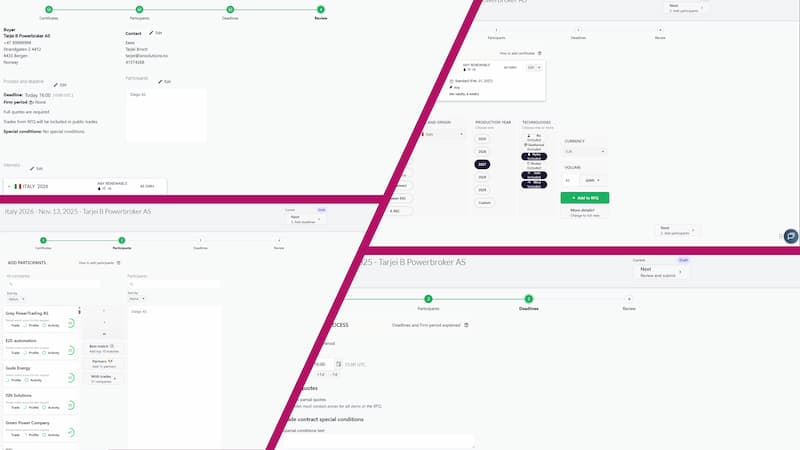

Advanced RFQ Management

Create detailed RFQs with custom criteria, invite specific participants, and manage the full quote lifecycle. Set deadlines, review competitive quotes, and negotiate through both public (anonymous) and private chats. Streamline complex transactions with structured workflows and automated documentation.

Built-in Counterparty Protection

Every participant undergoes KYC verification and credit checks. Manage custom counterparty lists with color-coded permissions, track trading history, and access credit status indicators. E-signature automation ensures all contracts are properly executed and stored for compliance.

Your Trading Toolkit

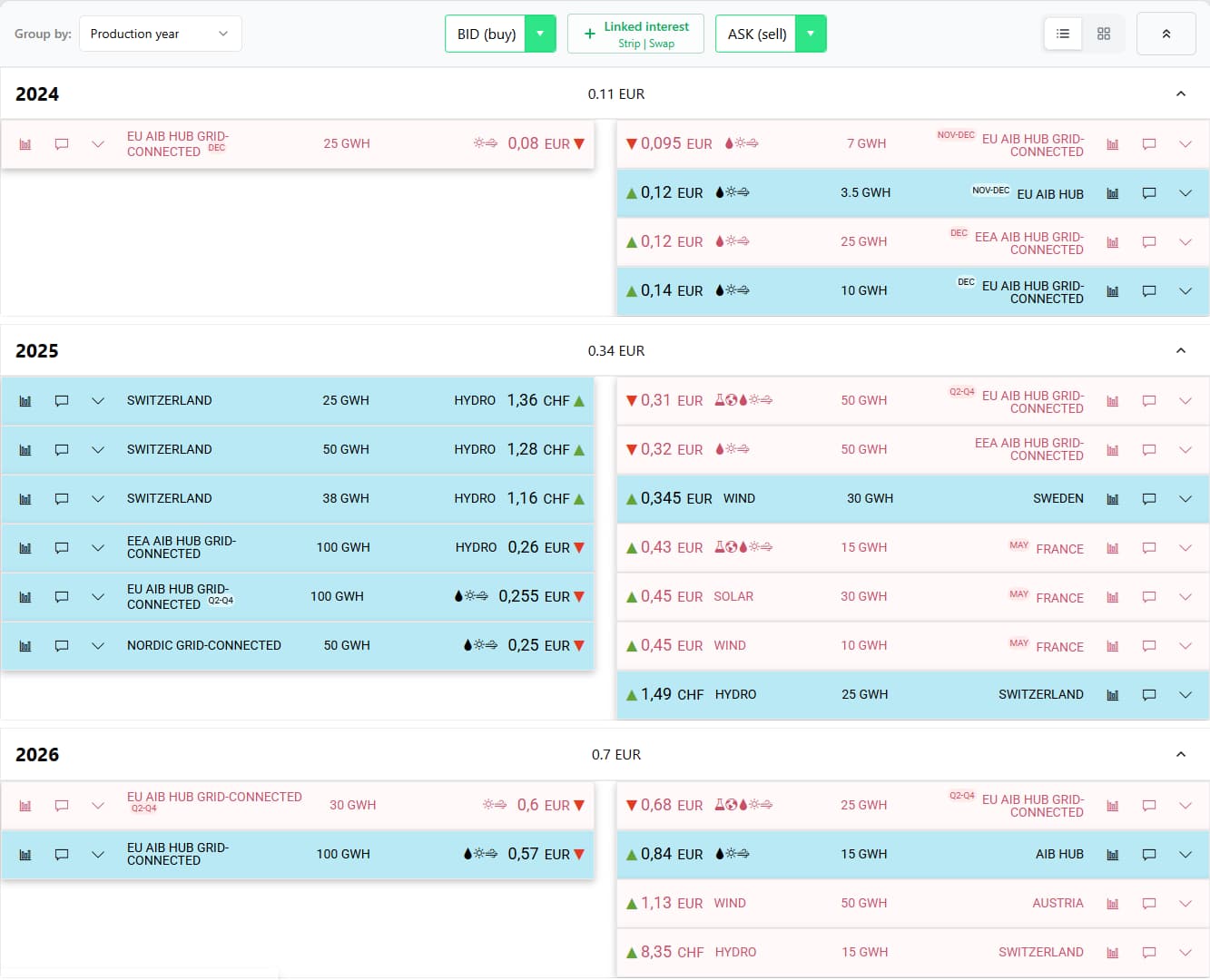

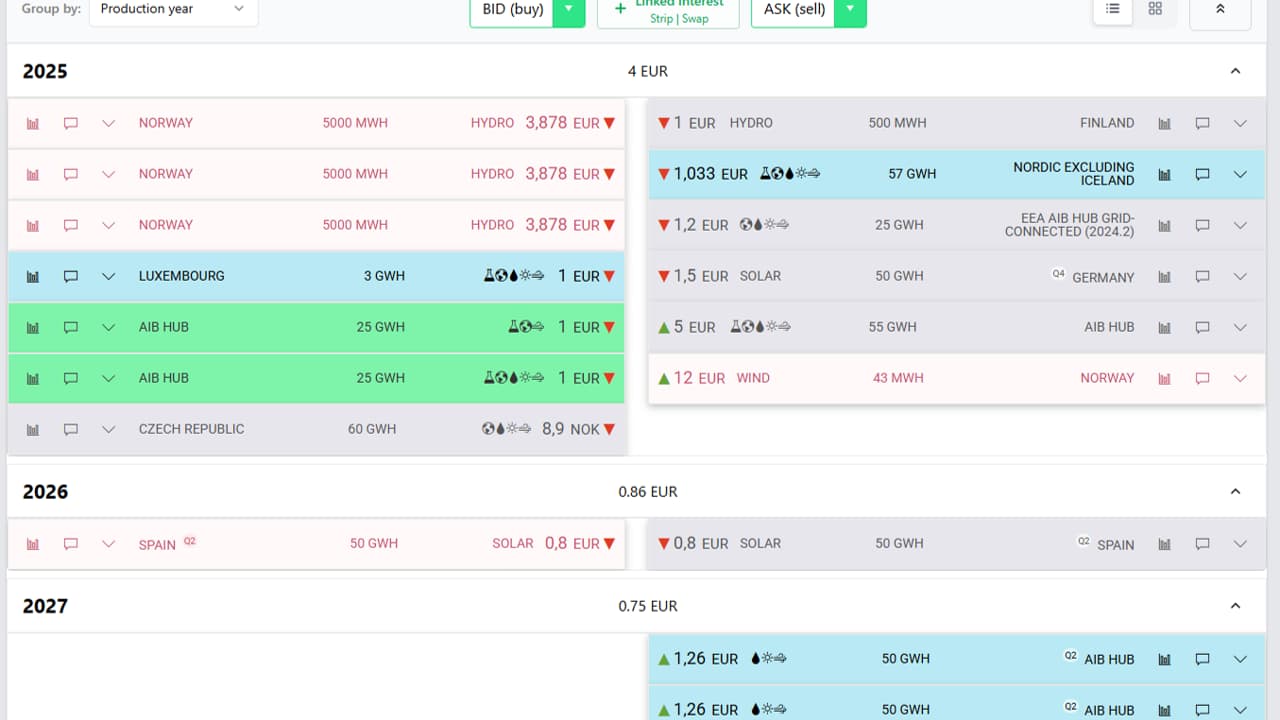

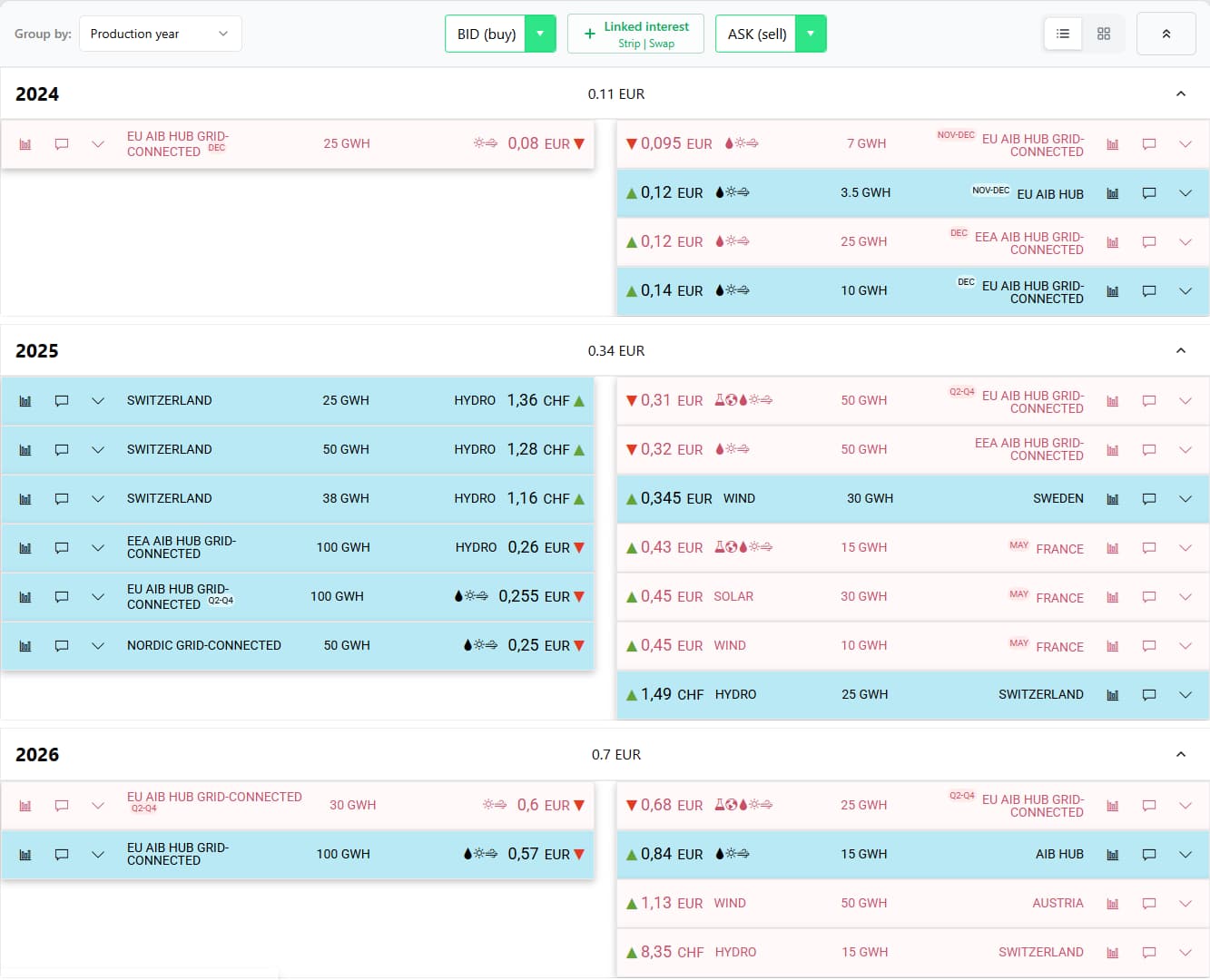

Live Marketplace

Real-time bid/offer matching with instant execution. View live interest across multiple products, vintages, and regions with transparent pricing.

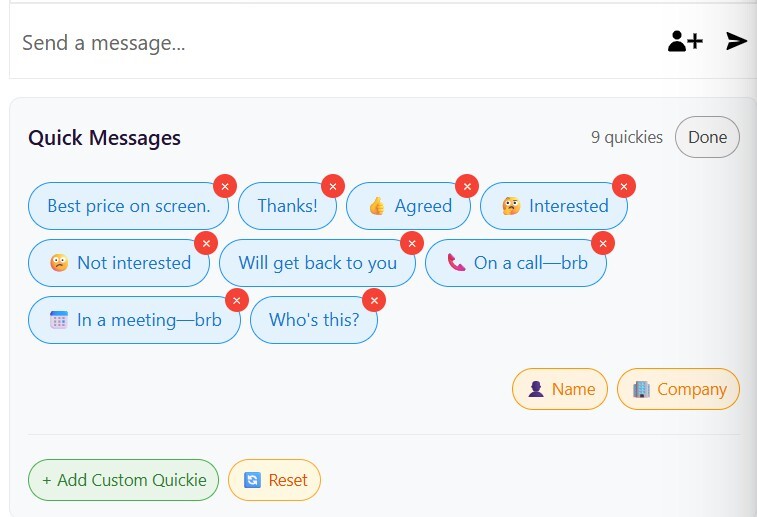

Chat Negotiation

Anonymous public chat for price discovery and private chat channels once you engage. Maintain confidentiality while exploring trading opportunities.

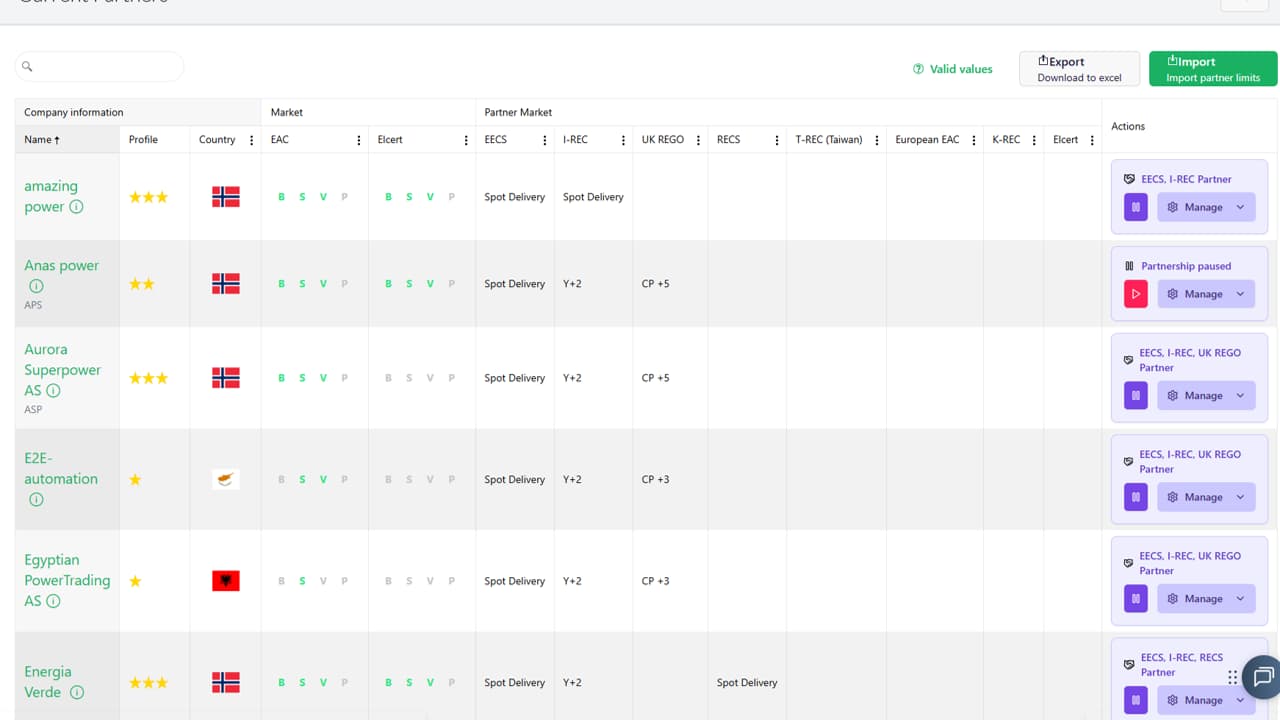

Counterparty Management

Color-coded lists to control who can trade with you. Green (approved), Red (blocked), Blue (Subject to contract and credit). Update preferences anytime.

E-Signature Automation

Auto-generated trade confirmations with built-in e-signature workflow. Industry-standard contract templates executed in minutes, not days.

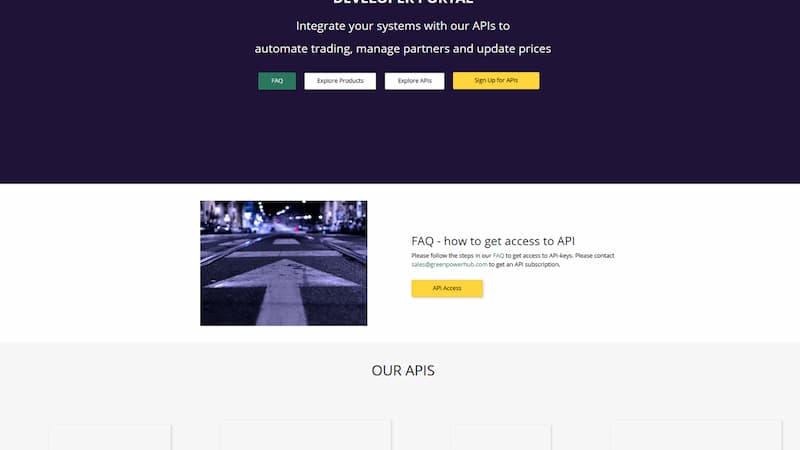

API Integration

Seamlessly integrate trade execution, pricing data, and portfolio monitoring with your internal systems via our comprehensive API.

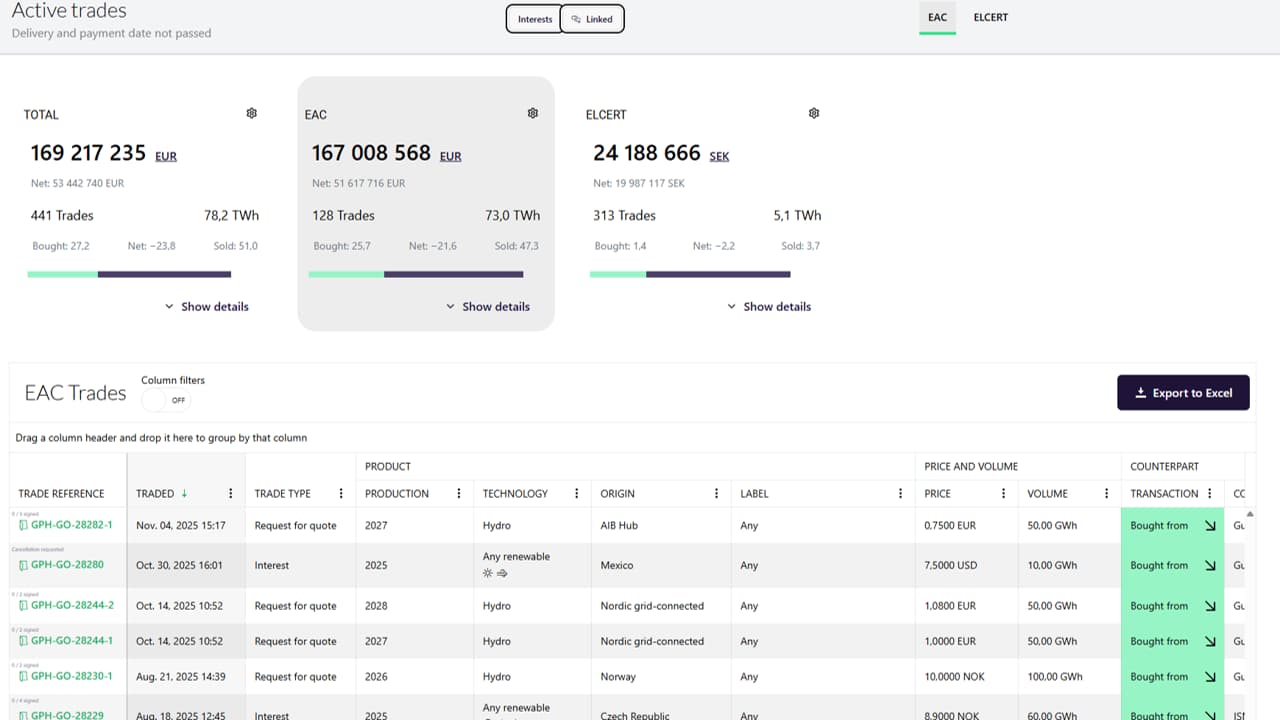

Portfolio Dashboard

Centralized view of all positions, trade history, and performance analytics. Track executed trades and monitor post-trading contract obligations.

Supported Trading Protocols

How it works

Sign Up for Trial

Complete KYC verification and get instant access to the platform. Start with our Trade First, Pay Later program at just €0.01/MWh.

Post Interest or Create RFQ

Browse live marketplace interest or create custom RFQs. Use chat to negotiate and manage your counterparty lists.

Execute & Monitor

Confirm trades with automated e-signature workflows. Track all positions and performance in your portfolio dashboard.

Frequently Asked Questions

How does the Trade First, Pay Later trial program work?

During the trial period, you can actively participate in trading with no upfront platform fees. You only pay €0.01/MWh on completed transactions. This allows you to test the platform's functionality, liquidity, and execution capabilities with minimal financial commitment. The trial requires active participation — simply registering is not enough to maintain trial status.

What's the difference between Marketplace and RFQ trading?

Marketplace Trading: Post firm, actionable trading intentions (buy or sell) that are visible to your approved counterparties. Respond to live interest in real-time with instant execution. Best for standard products and quick transactions.

RFQ Trading: Create detailed requests with custom criteria (product, volume, delivery, etc.) and invite specific participants. Receive competitive quotes, compare offers, and negotiate terms. Ideal for complex transactions, larger volumes, or specific counterparty requirements.

How does counterparty management work?

You control who can trade with you through our color-coded system:

- Green List: Approved counterparties who can see and respond to your marketplace interest

- Red List: Blocked counterparties who cannot interact with you

- Blue List: Restricted to RFQ-only interactions (not visible in marketplace)

All counterparties undergo KYC and credit checks. You can update your lists anytime based on trading history, credit status, or relationship preferences.

What are the platform fees after the trial?

Our pricing is transparent and competitive. Standard transaction fees apply after your trial period concludes. Contact our team at desk@greenpowerhub.com for detailed pricing information based on your expected trading volume and requirements.

Can I integrate the platform with my internal systems?

Yes, we offer comprehensive API access for seamless integration. You can connect trade execution, real-time pricing data, portfolio monitoring, and reporting with your internal systems. Our API documentation includes endpoints for all major trading functions, and our technical team can assist with integration support.

Unlock the Value of Your Green Energy with GreenPowerHub

From small-scale to utility projects — streamlined solutions that give you control and speed.